Integra has been providing technical loss adjusting services to the construction and energy insurance market for more than 23 years. In that time, we have seen at first-hand how the success of projects can be directly influenced by an effective programme of risk engineering activities. Integra Risk Services Managing Director, Paul Latimer talks to Integra Head of Marketing & Communications Doug Horne about why Integra has decided to create a risk services business and in the first instance provide risk engineering management for construction projects, no matter their size or geographical location.

Doug: Paul, tell us a bit about yourself?

Paul: I graduated with a masters degree in Civil Engineering, Design and Management. Then I joined the insurance market, working within the construction team at Willis before moving on to JLT. After 10 years as a broker, I moved into underwriting. I set up the construction and engineering portfolio at Catlin before moving to Travelers to establish their international construction portfolio. I joined the Integra leadership team in September to head up the risk services business and help to grow its long-established loss adjusting practice. Integra’s hard-earned reputation as a trusted partner to insurers and brokers feels like the perfect foundation for a complementary risk engineering offering.

Doug: Why is risk engineering so important?

Paul: There’s no doubt that the importance of risk engineering is well recognised by all those involved in the sector, especially on construction policies. It gives insurers an expert view of the exposures on the project they are insuring. And gives the insured access to the insurer’s and the risk engineer’s previous experience across many similar projects.

Doug: So why isn’t it taken up more frequently then?

Paul: Good question. Basically, to be really effective, a risk engineering programme needs significant time, effort and input from people who are appropriately qualified. This typically falls to a lead underwriter, but inevitably eats into their time and diverts them from their prinicipal role. Even where an insurance company has its own in-house engineers, they are often fully occupied with operational programmes. It takes time to identify, plan and engage with independent risk engineers, so surveys simply aren’t carried out in a number of cases. This has been the situation in insurance for as long as I’ve been in the industry, and quite possibly many years before.

Doug: So is there a solution?

Paul: If you can find a way of removing the day-to-day management of these programmes, opening a flow of information to and from the risk engineers, and managing the payment process, then lead underwriters can make sure that many more surveys are carried out. And do this without being distracted from their principal everyday activities.

Doug: And I guess that is where Integra comes in?

Paul: That’s right. I’ve joined Integra to set up a risk services business with exactly that purpose. Here I can combine my broker and underwriter experience with the expertise and knowledge of Integra’s technical loss adjusters. Integra Risk Services offers outsourced risk engineering management to the construction and engineering markets. We do this through a fully costed formal programme of risk engineering activities developed for the duration of the project. This includes, amongst other things, a full review of project information, loss insights and lessons learnt, a detailed proposal for risk engineering in line with LEG (London Engineering Group) Protocol, monthly collection of progress reports and schedules, collection and payment of fees with full audit trail, and also, very importantly, the mechanism to return unspent fees to the markets.

Doug: What does this mean for brokers and insurers?

Paul: Risk engineering is a really valuable tool for demonstrating to management or treaty reinsurers that insurers are carefully monitoring their live portfolio. It also helps with project programming as risk engineers can flag up any anticipated delays to the overall completion date. This can benefit brokers and insurers with time savings of over 120 man-hours associated with programme development, fee management and administration. Also, insurers can expect cost savings averaging 20%, as only the detailed budgeted fee is utilised, with the balance returned to participating insurers.

Doug: Is this service available now?

Paul: Integra Risk Services launched at the start of 2022 and we now have five live risk engineering management projects. So if anyone wants to find out more about how we can help, I’m more than happy to discuss.

Integra Technical Services has today launched a new subsidiary, Integra Risk Services, to complement its loss adjusting business, which is trusted by brokers and insurers to settle claims emanating from specialty lines sectors.

Risk Engineering Management is the initial service Integra Risk Services is bringing to the Construction, Engineering, and Energy including Renewables markets. The service being offered enables insurers to closely monitor their portfolio of live projects to ensure the appropriate amount of risk engineering is being applied to their projects, the risk engineers’ reports are being delivered on time and costs being managed tightly.

Integra Risk Services designs and delivers comprehensive management of all risk engineering activities, utilising a combination of our in-house risk engineers, who have different sector specialisms, as well as the services of specialist global risk engineers. The combination of the two will deliver project specific insight as well as lessons learned from claims that have arisen in the past from projects that are comparable to those being surveyed.

Paul Latimer, Managing Director Integra Risk Services, said “Having spent over 25 years within the insurance industry as both a broker and an underwriter, I am fully aware of the challenges faced by insurers and brokers in the delivery of risk engineering programmes. Our goal is to provide a trusted and reliable outsourced service to our clients that will provide time savings in excess of 120-man hours associated with programme development, fee management and administration per project. I am delighted by the support and feedback received from the market so far and I look forward to creating value for our clients going forward.”

Integra Risk Services is also able to offer additional services such as detailed electronic schedule analysis, pre-bind engineering reports, desktop reviews, and ESG due diligence.

Leo Dixon, Chief Executive Officer, Integra Technical Services added, “The importance of risk engineering on a construction policy is recognised by all, however for years insurers subscribing to projects have been paying for a service that is not being fully utilised or in some instances not provided at all. Integra Risk Services has been developed to help solve this as well as other challenges the industry faces. Paul has already shown his value to Integra through his sector knowledge and connections, and I’m excited to see the positive impact our Risk Engineering Management service has for our Insurer and Broker clients.”

by Paul Latimer

Environmental, social and governance criteria – ESG, or sustainability, as it is also known – are key drivers for long-term company investment and infrastructure policies. No longer a ‘tick-the-box’ exercise, regulatory frameworks to establish ESG credentials for all sectors are being formulated worldwide.

This has, and will continue to have, a significant impact on the insurance sector.

What is ESG?

Company policy must consider these criteria:

ENVIRONMENTAL

How a business interacts with the natural environment Waste and pollution, resource depletion, greenhouse gas emissions, deforestation and climate change.

SOCIAL

How a company treats people Employee relations and diversity, working conditions, child labour and slavery, impact on local communities, and funding projects serving poor and underserved communities globally.

GOVERNANCE

How a corporation is governed and polices itself.

Tax strategy, executive remuneration, donations and political lobbying, corruption and bribery, board diversity and structure.

17 sustainable development goals (SDGs) were adopted by UN member states in 2015. These are designed to transform our world with a universal call to action to end poverty, protect the planet and improve the lives and prospects of everyone, everywhere.

How is ESG policed?

Most major ‘westernised’ countries are committing to cut greenhouse gas emissions, rapidly reduce renewable energy costs and effect social change. The UN-backed global initiative Principles for Responsible Investment (PRI) was launched in 2006. Aimed at creating a sustainable financial system, it now has over 3,000 signatories.

The UK was the first G7 country to legally formalise the target of becoming a net zero carbon area by 2050. The current administration’s ten-point plan for a “green industrial revolution”, involves £12 billion of public spending.

The US has re-joined the Paris Agreement on climate change and is prioritising reaching net-zero greenhouse gas emissions by 2050. The US power sector should be decarbonised by 2035.

Regulatory frameworks will be used to guide project/asset management and risk management going forward. However, data is sketchy with a patchwork of reporting frameworks around the world. Standardisation is lacking and regulators are being forced to address this.

Companies are facing regulatory and investor pressure to give ESG policy greater weight in decision-making and strategy or face long-term negative consequences. However, greenwashing is on the increase.

How does ESG affect the insurance sector?

Climate, natural catastrophe, extreme weather and fire remain the main causes of insurance claims in the property and construction sectors in the long term. This is before the impact of the pandemic, which has not yet been

fully assessed.

New ESG-led regulations will mean less demand for coal, oil and gas over the coming decades, potentially making some uninsurable in the long term. Having initially focused their efforts on integrating ESG filters into asset management activities, insurers are now looking at the underwriting side of the business.

Major insurers are implementing ESG frameworks that will limit their appetite for non-ESG risks and employing ESG experts to oversee this. New start-ups like Parhelion aim to offer green and sustainable insurance, arguing that without ‘green’ insurance company supply chains will not be

fully sustainable.

How can insurers lead by example?

Insurers should be considering how to help clients with sustainability initiatives and providing new products. Lloyd’s is embracing ESG with a leadership role. The Sustainable Markets Initiative (SMI) Insurance Task Force was convened by HRH Prince of Wales and chaired by Lloyd’s to be an “influential platform for the sector to collectively advance the world’s progress towards a resilient, net-zero economy”.

For underwriting, ESG means a drive to a low-carbon global economy. There is increasing pressure not to underwrite certain exposures. New strategies will be needed to insure fossil fuel assets, for example, as public opinion and ESG requirements make it harder.

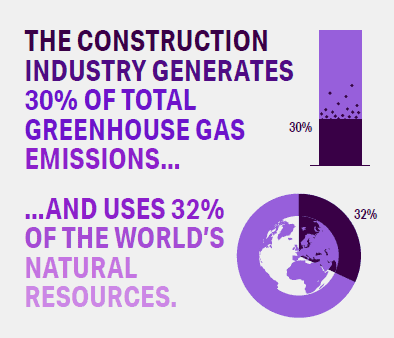

The construction industry generates 30% of total greenhouse gas emissions and uses 32% of the world’s natural resources. The cumulative volume of construction is expected to reach US$212 trillion by 2030. As the largest contributor to climate change, the construction industry will need to make the greatest reductions.

Companies that ignore ESG will lose relevance and market position. To maintain credibility they must act before being forced to.

How will loss adjusters need to adapt?

Loss adjusters will need to advise on rectification works that comply with client ESG criteria and current regulations. They will need to know what is “equivalent” and what would be “betterment” and interpret

cover accordingly.

A robust due diligence process from risk assessment to claim fulfilment will be key.

What will the future bring?

While ESG-assessed risk only accounts for a small percentage of the market currently, it is becoming increasingly significant.

The time to act is now